Pay off debt and achieve your financial goals.

Expert guidance on how to eliminate debt and take control of your financial future.

We were carrying $213,931 in debt, it would have taken us 30 years to pay off. Now, we’ll pay it off in 9 years.

Shelly J.

How does Debt Free Life® work?

Debt Free life is a modern way to pay off your debt using the cash value of a specialized whole life insurance policy.

Start Living Debt Free

Once your debts are paid off, you can use your policy funds for large purchases, retirement, or a child’s education.

I appreciate being more educated on how to better handle our finances.

L. Dillworth

Are you on track to achieve your financial goals?

Or is debt getting in the way?

Join thousands on the path to financial freedom.

I know the month and year we’ll be out of debt.

Jennifer B.

Ready To Get Started?

Schedule a Consultation

Review Your Personalized

Debt Elimination Report

Take Back Control

Continued Support From

Your Dedicated Consultant

Submit some basic information then meet with a certified Debt Free Life consultant online or in person.

Learn more about your debt and scheduled interest in your personalized debt elimination report.

Your consultant will show you how to redirect your inefficient funds into a specialized whole life insurance policy to pay off your debts and reduce interest.

Your certified Debt Free Life consultant will provide continued support throughout the process to help you get out of debt and achieve your financial goals.

Ready To Get Started?

Schedule a Consultation

Submit some basic information then meet with a certified Debt Free Life consultant online or in person.

Review Your Personalized

Debt Elimination Report

Learn more about your debt and scheduled interest in your personalized debt elimination report.

Take Back Control

Your consultant will show you how to redirect your inefficient funds into a specialized whole life insurance policy to pay off your debts and reduce interest.

Continued Support From

Your Dedicated Consultant

Your certified Debt Free Life consultant will provide continued support throughout the process to help you get out of debt and achieve your financial goals.

In 6.5 years, I’ll be debt free and saving over $108,000 in interest.

Patrick D.

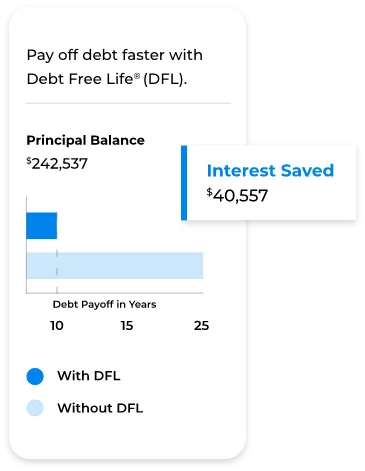

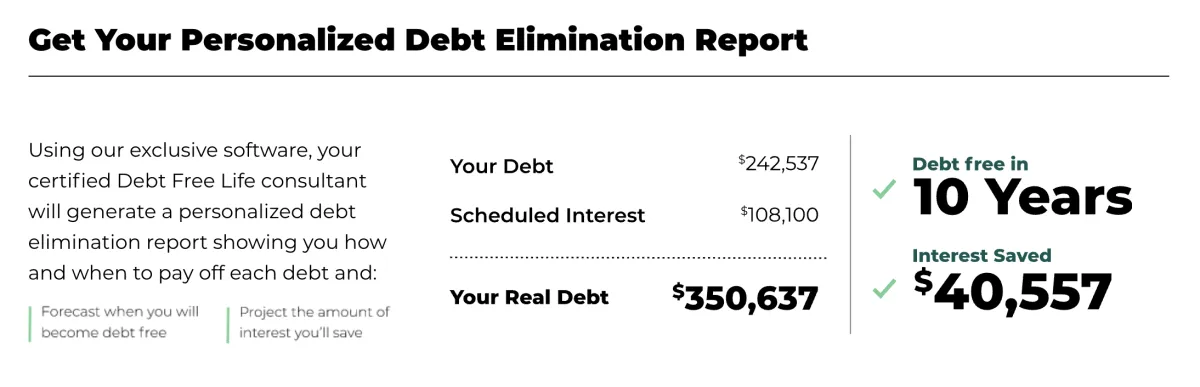

Personalized Debt Elimination Report

Your certified Debt Free Life consultant will present a personalized report to visually represent your debts and scheduled interest. Your consultant will show you how redirecting inefficient dollars into the cash value of a whole life insurance policy will help you eliminate debt incrementally and build savings. You will also find out when you’ll become debt free and see how much interest you will save.

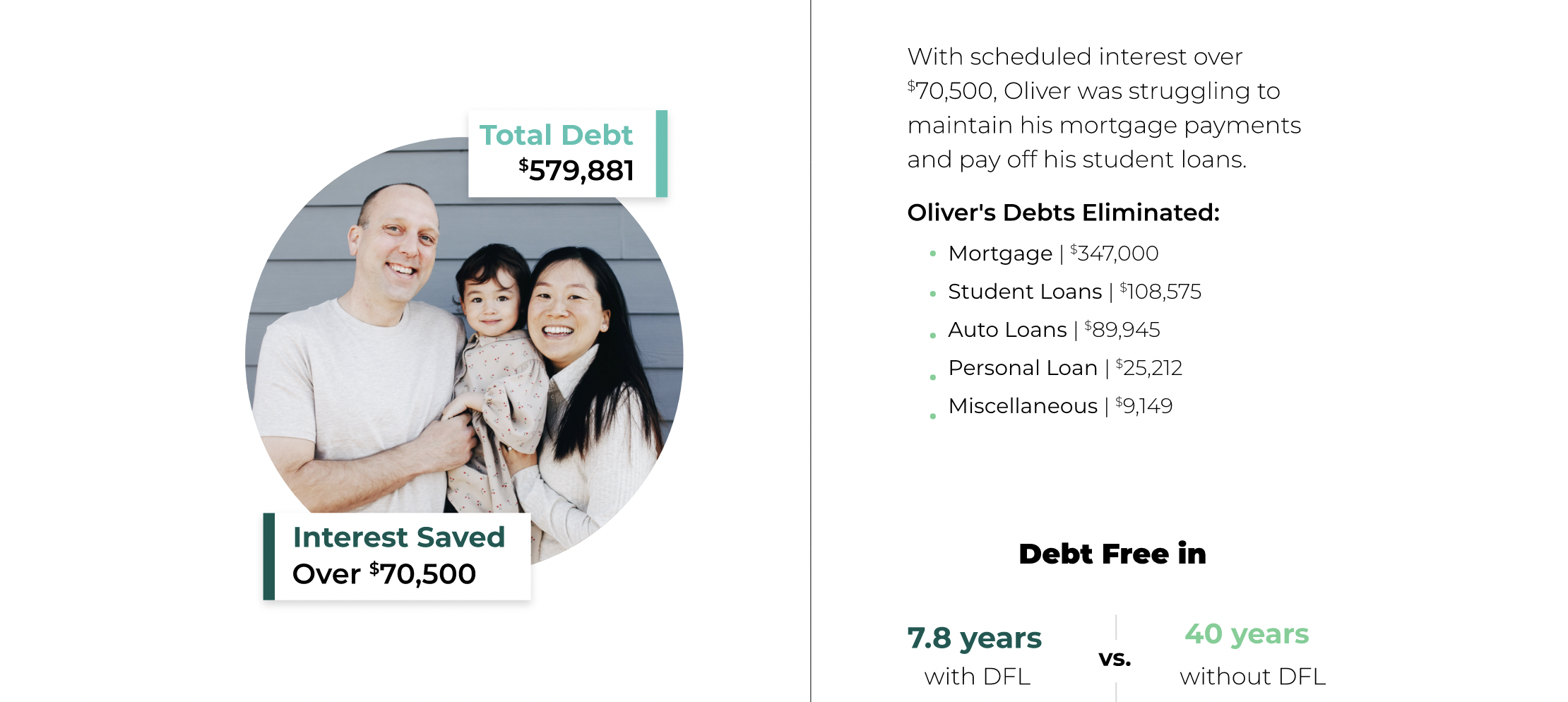

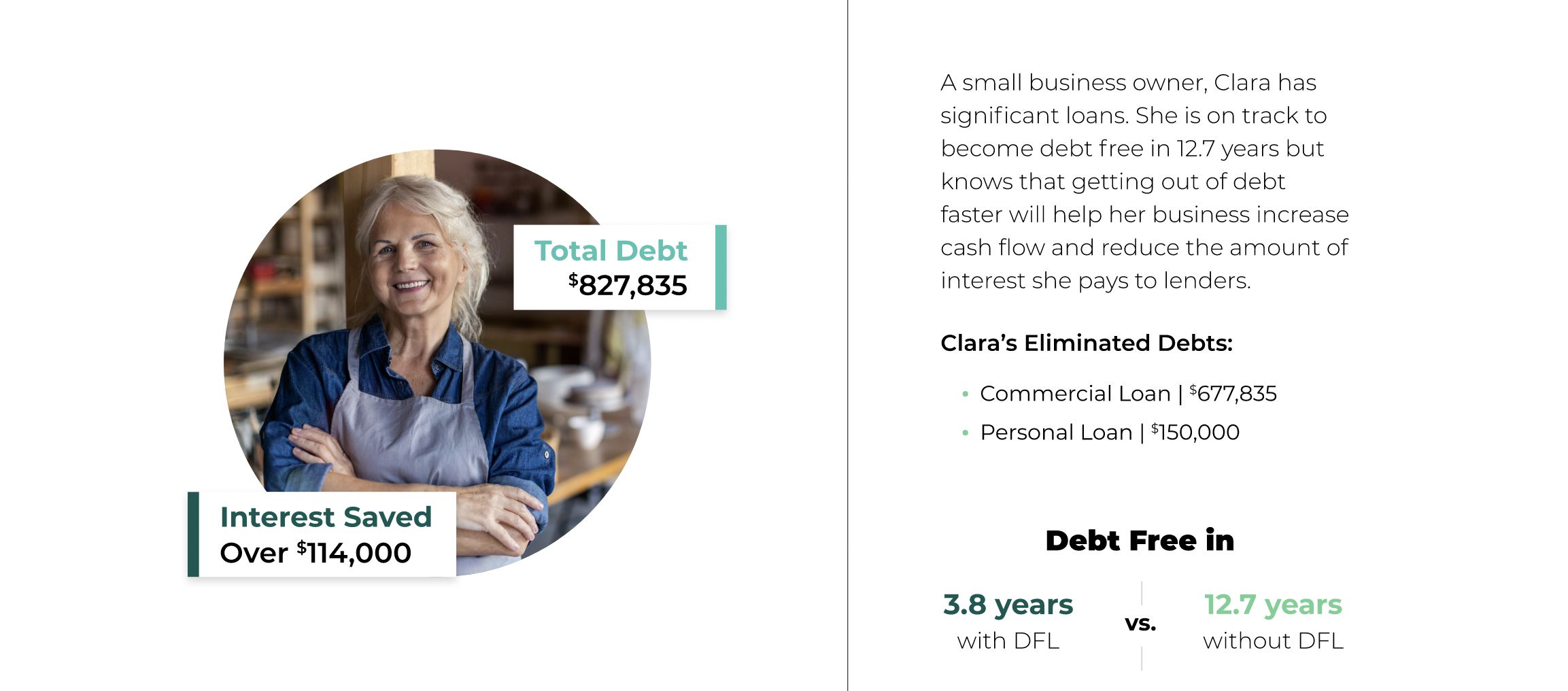

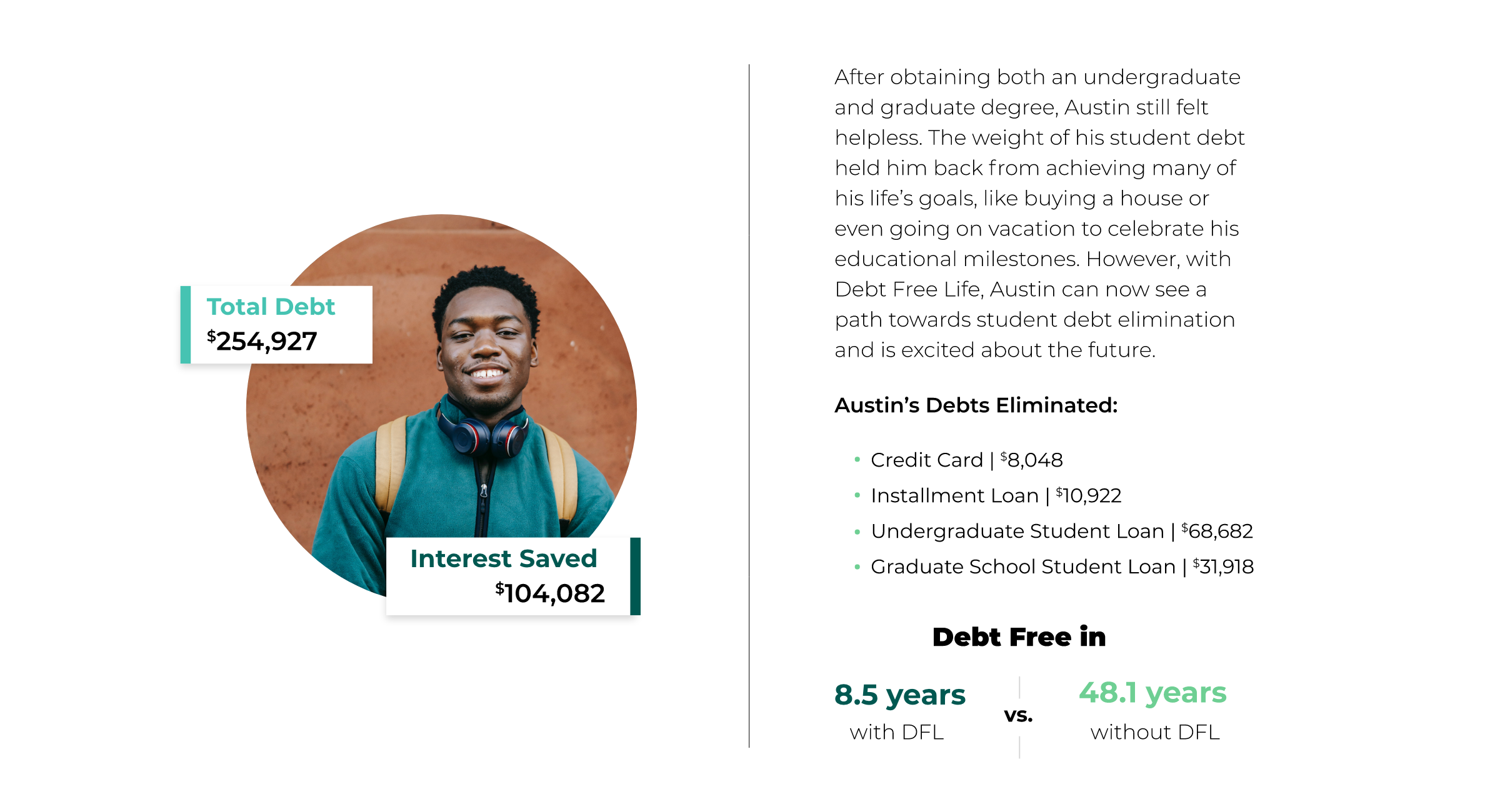

See how Debt Free Life helps our clients.

Start Achieving Your Financial Goals

Debt Free Life helps you eliminate debt with the cash value savings component of a permanent life insurance policy. Read more about permanent life insurance and how these specialized policies can help you achieve your financial goals.

FAQ's

We’ve got you covered.

When should I begin my Debt Free Life journey?

As soon as you are ready to start paying off debt! It’s simple to get started – begin by filling out our short form and a certified Debt Free Life consultant will be in touch to schedule your free consultation.

How much does Debt Free Life cost?

By redirecting overpayments or discretionary income into the cash value of your policy, you become your own bank and pay off debts with no additional out-of-pocket expenses. Premiums for whole life insurance, like other types of life insurance, depend on your age and health at the time you apply.

What can I expect during my free consultation?

In your first consultation with your Debt Free Life consultant, you will discuss your existing debts, interest rates, principal balances and all current payments you’re making towards debts. Your consultant will then use our exclusive Debt Free Life software to break down the amortization schedule for each debt to find the point where more money will be going to principal, rather than interest.

Is Debt Free Life a debt consolidation plan?

No, Debt Free Life helps make your money work for you by utilizing cash value within a life insurance policy. With the guidance of your certified Debt Free Life consultant, you will eliminate debts and interest owed over time while accruing additional tax-favored funds within the policy’s cash value.

What are the advantages of Debt Free Life?

The main advantage of Debt Free Life is putting you back in control of your finances by eliminating debt. You will also reduce the amount of interest paid to lenders while accruing funds in the cash value component of a whole life insurance policy.

Will Debt Free Life impact my credit score?

As you pay off debts with the guidance of a certified Debt Free Life consultant, your credit score may improve. There are no credit checks required when applying for a life insurance policy.

DEBT FREE LIFE

Benefits of Being Debt Free

Beyond financial confidence, there are many benefits to living a debt free life.

DEBT FREE LIFE

Managing Debt During COVID-19

Get some tips for managing your budget + learn how Debt Free Life can help.

DEBT FREE LIFE

How Debt Free Life Works

Learn how the Debt Free Life plan can help you pay off debt + save for retirement.

Let’s Get Started

Are you ready to become debt free?

Get out of debt and take control of your

financial future. Connect with a Debt Free Life®

consultant today.

“Quility” is a brand name used by the Quility family of companies. All insurance offers, solicitations, and recommendations made via this website are being made by Quility’s licensed affiliated insurance producers, Symmetry Financial Group, LLC (d/b/a Symmetry Insurance Services in California) and Brandon Ellison. No offers, solicitations or recommendations are being made via this website in any state where one of those named Quility licensees does not have a license. Please see our License Page for a list of all of Symmetry Financial Group, LLC’s (d/b/a Symmetry Insurance Services in California) and Brandon Ellison’s license numbers in each state.

***location_id***pymntCQWP5AFYFwFHt8k

***custom_primary_color***

***custom_secondary_color***

Copyright © 2021 Symmetry Financial Group. All Rights Reserved. | Privacy | Site Map

“Quility” is a brand name used by the Quility family of companies. All insurance offers, solicitations, and recommendations made via this website are being made by Quility’s licensed affiliated insurance producers, Symmetry Financial Group, LLC (d/b/a Symmetry Insurance Services in California) and . No offers, solicitations or recommendations are being made via this website in any state where one of those named Quility licensees does not have a license. Please see our License Page for a list of all of Symmetry Financial Group, LLC’s (d/b/a Symmetry Insurance Services in California) and ’s license numbers in each state.

- custom_values.agent_bio=I'm from Oklahoma, grew up in the country. I have two older kids that are almost 21 and 19! And a little girl who is attached to my hip. She's almost 10 years old. My broke little best friend! I love coaching my daughters sports teams. I love just being a dad in general. I love basketball, hunting and fishing. And tacos. I do love tacos! I enjoy meeting with my clients and getting to learn more about them and their families. Helping people and leaving them better than when I found them is something I truly enjoy doing now. Being able to do all that from home has completely changed my life being able to be present and provide at the same time. I am licensed to help with anything life insurance, funeral coverage, college savings plans, retirement planning, helping people become debt free in 9 years or less, and even assist in becoming your own bank and borrowing money from yourself.

- custom_values.agent_brokerage=

- custom_values.agent_headshot=https://storage.googleapis.com/msgsndr/pymntCQWP5AFYFwFHt8k/media/652d5ffdedd4b422cc16f3ee.webp

- custom_values.agent_name=

- custom_values.agent_phone=

- custom_values.agent_title=

- custom_values.agentemail=

- custom_values.booking_page_link=

- custom_values.booking_thank_you_page=

- custom_values.brag_link=

- custom_values.claim_thank_you_page=

- custom_values.confirm_sale=

- custom_values.final_expense_booking_page=

- custom_values.from_email=

- custom_values.insurance_license_number=

- custom_values.life_insurance_landing_page=

- custom_values.logo_image_url=

- custom_values.outbound_email=

- custom_values.recruiting_booking_link=

- custom_values.twilio_number=

- custom_values.twilio_number_in_link_form=

- custom_values.licensenumber=